Tax refund interest calculator

The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West Virginia tax liabilities. This calculator is updated with rates and information for your 2021 taxes which youll file in 2022.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

If you use this method but end up earning more money in.

. The income tax department had previously announced that from March 1 2019 it will issue only e-refunds. Fastest Refund Possible. Taxfyles small business tax calculator accurately estimates your business tax refundliability at the end of the year.

This calculator is for 2022 Tax Returns due in 2023. Computation of these amounts is based on application of. LLC S-Corp C-Corp - you name it well calculate it.

Here is a step-by-step guide to pre-validate a bank account on the new income tax portal. To avoid the possibility of this occurring in step 3 the date the late returnlate payment will be received should be. The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable.

Looking for a quick snapshot tax illustration and example of how to calculate your. The 1040 income tax calculator helps to determine the amount of income tax due or owed to the IRS. Calculate your total tax due using the CA tax calculator update to include the 202223 tax brackets.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Yes No Early Withdrawl of Retirement Penalty. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

The IRS issues more than 9 out of 10 refunds in less than 21 days. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe. Your tax situation is complex.

Estimate your refund with TaxCaster the free tax calculator that stays up to date on the. Federal Income Tax Calculator 2022 federal income tax calculator. Tax Refund Calculator.

It is not your tax refund. Estimate your tax refund using TaxActs free tax calculator. This includes alternative minimum tax long-term capital gains or qualified dividends.

The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. 202223 Tax Refund Calculator. To avoid the IRS underpayment penalty you can choose between the following approaches.

This is an optional tax refund-related loan from MetaBank NA. Yes No Educator Expenses. Taxable interest Taxable interest Ordinary dividends Taxable refunds credits offsets etc.

SARS Tax Refund Calculator for 2022 Work out how big your tax refund will be when you submit your return to SARS. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

Ordinary income passive income qualified business income non-taxable income eg. Yes No Casualty. You can also estimate your tax refund if applicable.

Deduct the amount of tax paid from the tax. Student Loan Interest Tuition and Fees Form 1098-T. These tax refunds will be credited only to those bank accounts which are linked with PAN and are also pre-validated on the new income tax e-filing website.

Tax refund time frames will vary. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Check our 2022 tax refund schedule for more information or use the IRS2Go app to learn your status.

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. Interest from municipal bonds etc your taxable income and applicable. Most BTL deductions are the run-of-the-mill variety above including several others like investment interest or tax preparation fees.

Just plug in the amount of the loan your current home value the interest rate the length of the loan any points or closing costs and your annual taxes insurance and PMI. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. Estimate your tax withholding with the new Form W-4P.

If the date you specify in this calculator is earlier than the date the Department receives your late returnlate payment you may receive a bill for additional late filinglate payment penalties and interest owed. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. You have nonresident alien status.

Tax filing season always begins in September after the tax year finishes. If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or adjustments that can boost your. It is mainly intended for residents of the US.

You should count another week into your time estimate if you request your refund as a check rather than a direct deposit. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. Loans are offered in amounts of 250 500 750 1250 or 3500.

202223 California State Tax Refund Calculator. 2022 than you did in 2021 or end up. Click here for a 2022 Federal Tax Refund Estimator.

See how income withholdings deductions and credits impact your tax refund or balance due. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. See Publication 505 Tax Withholding and Estimated Tax.

Yes the Income Tax department takes the responsibility of granting a simple interest 05 percent per month to compensate for the delayed refunds In the case of refund arising out of TDS TCS Advance Tax Interest is calculated 05 for every month or part of a month for a period starting on 1st April of the relevant AY till the date. Alimony received Business income or loss. And is based on the tax brackets of 2021 and 2022.

Fastest federal tax refund with e-file and direct deposit. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund.

If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount. For taxpayers who use married filing separate status the. Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction Earned Income Tax Credit EIC.

Tax Refund Estimator For 2021 Taxes in 2022. This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. For 2020 tax returns filed in 2021 the IRS said it planned to issue more than 90 of refunds within 21 days of e-filing.

Which tax year would you like to calculate.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

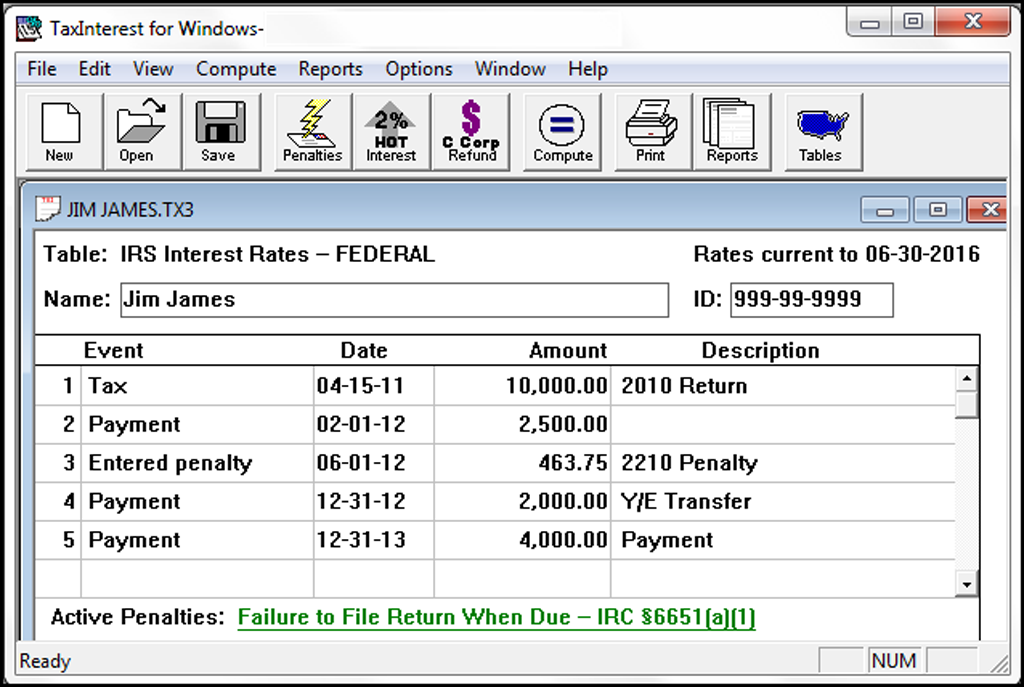

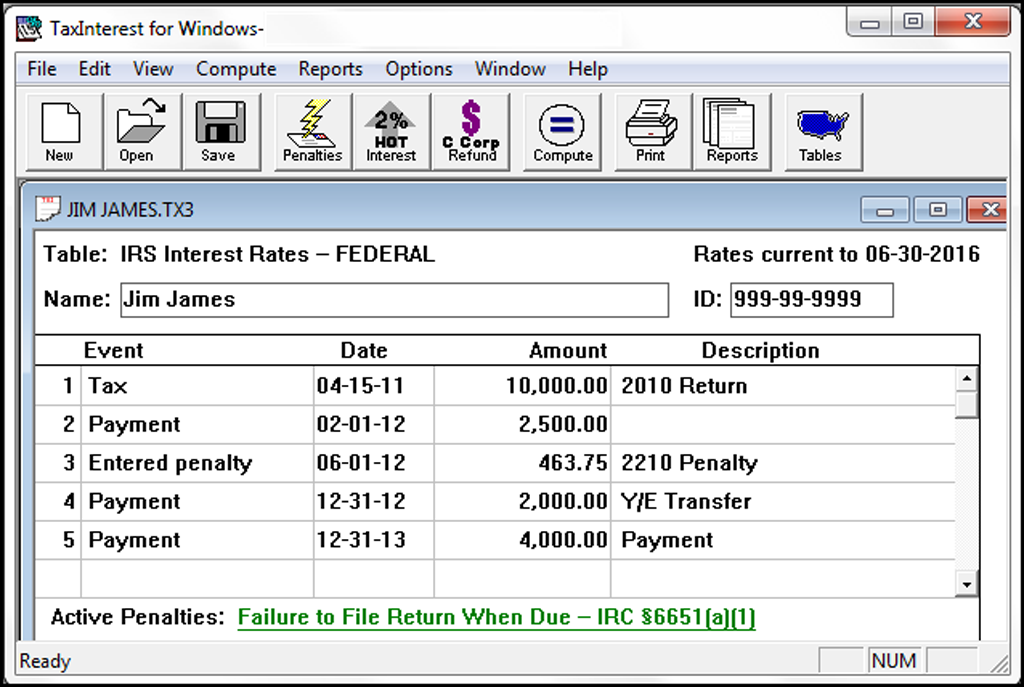

Taxinterest Irs Interest And Penalty Software Timevalue Software

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Calculator Estimate Your Income Tax For 2022 Free

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Tax Return Calculator How Much Will You Get Back In Taxes Tips

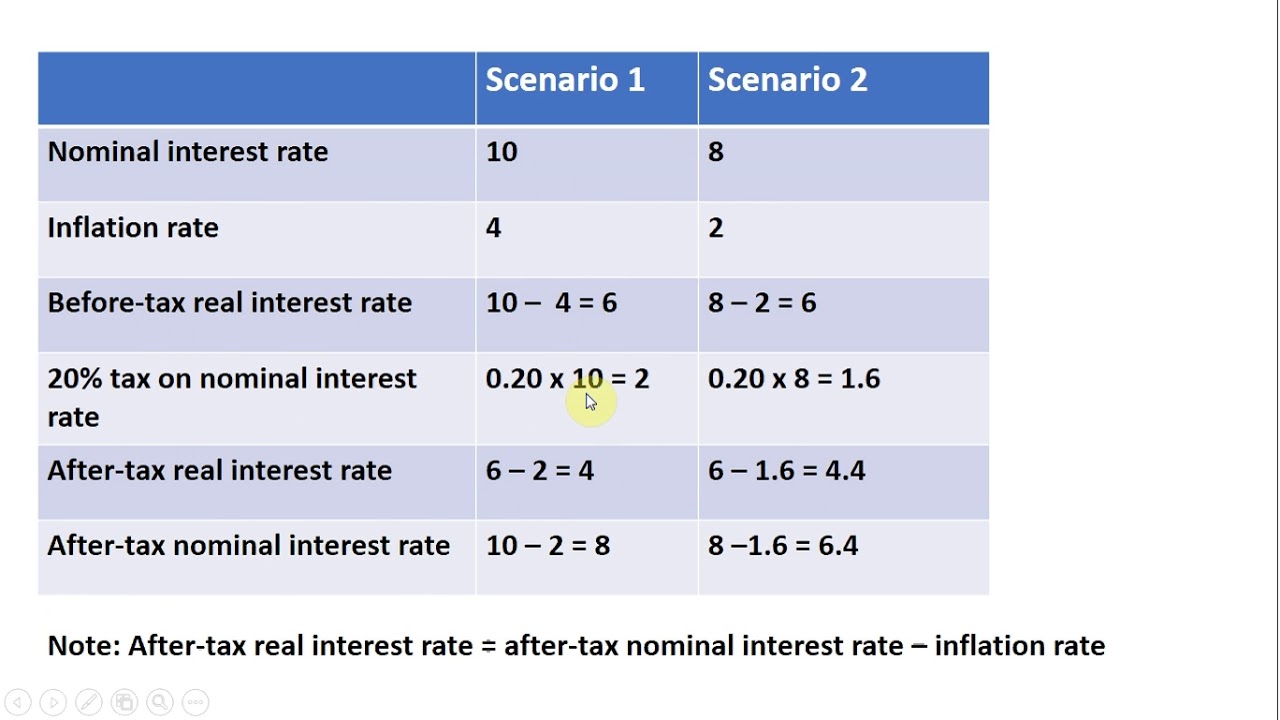

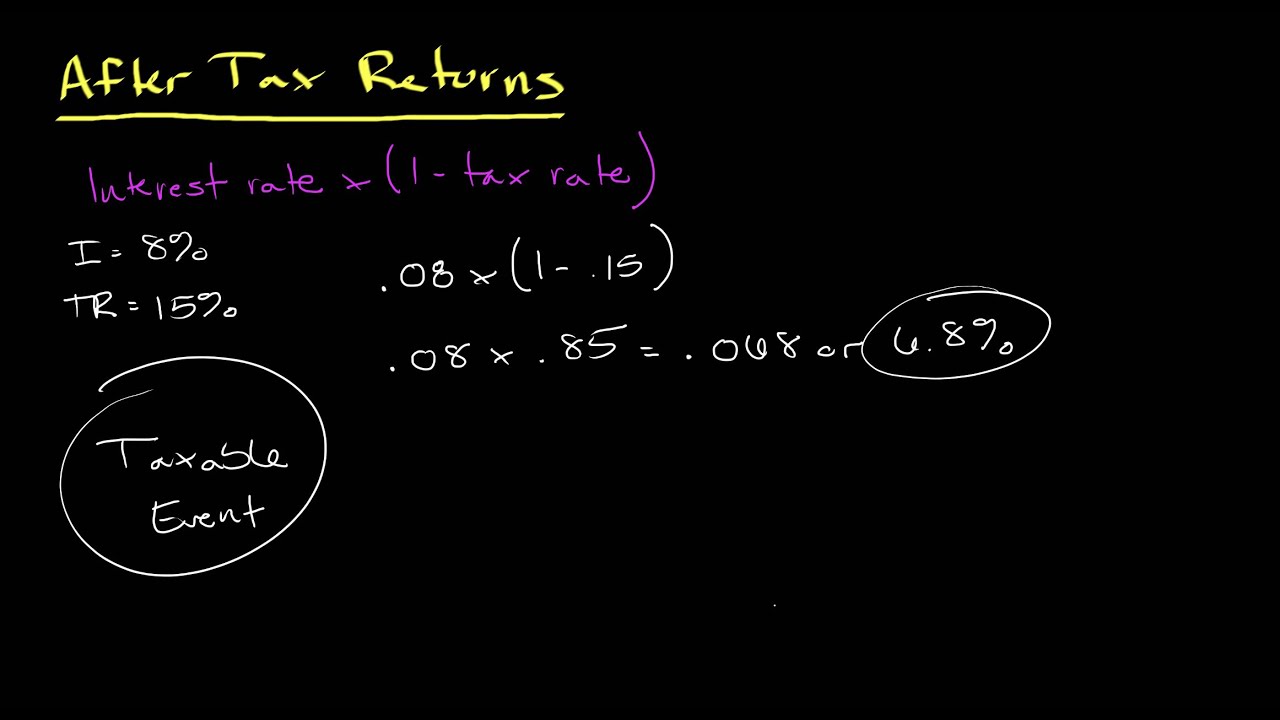

Calculating Before Tax And After Tax Real And Nominal Interest Rates Youtube

Simple Tax Refund Calculator Or Determine If You Ll Owe

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Calculating After Tax Returns Personal Finance Series Youtube